[X] | No fee required. | |||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1 | Title of each class of securities to which transaction applies: | |||

| 2 | Aggregate number of securities to which transaction applies: | |||

| 3 | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4 | Proposed aggregate value of transaction: | |||

| 5 | Total fee paid: | |||

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| [ ] | Fee paid previously with preliminary materials. | |||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1 | Amount previously paid: | |||

| 2 | Form, Schedule or Registration Statement No.: | |||

| 3 | Filing Party: | |||

| 4 | Date Filed: | |||

Sterling Construction Company, Inc.

1800 Hughes Landing Boulevard

The Woodlands, Texas 77380

Telephone: (281) 214-0800

Audit Corporate Governance Audit Compensation Director Chairman Audit Corporate Governance Paul J. (1)(2) Roger M. (1)(4) Kevan M. (5) Peter E. (6) Thomas R. (7) Committee Assignment(1)* Maarten D. Hemsley (nominee) Audit Corporate Governance Charles R. Patton (nominee) Richard O. Schaum (nominee) Audit Compensation* Milton L. Scott (nominee) Chairman of the Board Audit* Corporate Governance Paul J. Varello (nominee) Director, Chief Executive Officer Marian M. Davenport (continuing director) Compensation Corporate Governance* Chairman and Chief Executive Officer are management of risks associated with our board leadership structure, including committee appointments, size of board and nomination of board members, and corporate governance matters. The The Fees Earned or ($) Stock Awards ($) Total ($) Aggregate Stock at December 31, 2015 (#) Grant Date Fair Value of Stock Awards ($) Name and Address of Beneficial Owner Total Beneficial Ownership Percent of Class FMR LLC (1) 245 Summer Street, Boston, Massachusetts 02210 SEC. Based solely upon U.S. Concrete, Inc. Change in Control” on page 33. 2017 Summary Compensation Table Name and Principal Position Salary ($) Bonus ($) Stock Awards (1) ($) Non-Equity Incentive Plan Compensation ($) All Other Compen- (2) ($) Total ($) Paul J. Varello (3) Chief Executive Officer Since February 1, 2015 Ronald A. Ballschmiede (4) Executive Vice President & Since November 9, 2015 Roger M. Barzun (5) Senior Vice President & 2013 2014 2015 220,000 220,000 250,000 — — — — — — — — — — — — 220,000 220,000 250,000 Kevan M. Blair (6) Senior Vice President & Peter E. MacKenna President & Chief Executive January 1 – 31, 2015 2013 2014 2015 600,000 600,000 46,154 — — — 994,000 81,000 — 216,000 189,000 — 156,506 399,952 1,793,500 1,966,506 1,269,952 1,839,654 Thomas R. Wright Executive Vice President & January I – July 3, 2015 2013 2014 2015 84,808 350,000 200,962 100,000 — — 92,600 105,000 187,501 56,384 105,000 — 43,502 22,740 449,618 377,294 582,740 838,801 Estimated Possible Payouts Under Non-Equity Incentive Plan Awards ($) All Other Stock Awards: Number of Shares of Stock or Units Grant Date Fair Value of Stock and Option Awards Salary ($) Thomas R. Wright STIP Thomas R. Wright LTIP Number of (#) Aggregate on Vesting (1) ($) determined that each of Messrs. Hemsley and Scott qualifies as an “audit committee financial expert,” as such term is defined by the rules of the SEC. We operate under a written charter approved by us and adopted by the board of directors. Our primary function is to assist the board of directors in fulfilling the board’s oversight responsibilities relating to (1) the effectiveness of the company’s internal control over financial reporting, (2) the integrity of the company’s financial statements, (3) the company’s compliance with legal and regulatory requirements, (4) the qualifications and independence of the company’s independent registered public accounting firm, (5) the performance of the company’s independent registered public accounting firm and (6) the review and approval or ratification of any transaction that would require disclosure under Item 404(a) of Regulation S-K of the Exchange Act. Number of Shares of Stock or Units That Have Not Vested (1) (#) Market Value on December 31, 2015 of Shares of Stock or Units That Have Not Vested (2) ($) Number of (#) Market or Payout Value of Unearned Shares, Units or Other Rights That ($) Number of Securities (a) Weighted-average exercise price of warrants and rights (b) Number of securities remaining column (a) (c) December 2010 ($) December 2011 ($) December 2012 ($) December 2013 ($) December 2014 ($) December 2015 ($) All Other Fees (non-audit fees): on the internet. The notice also provides instructions on how to submit your proxy and voting instructions via the internet. If you

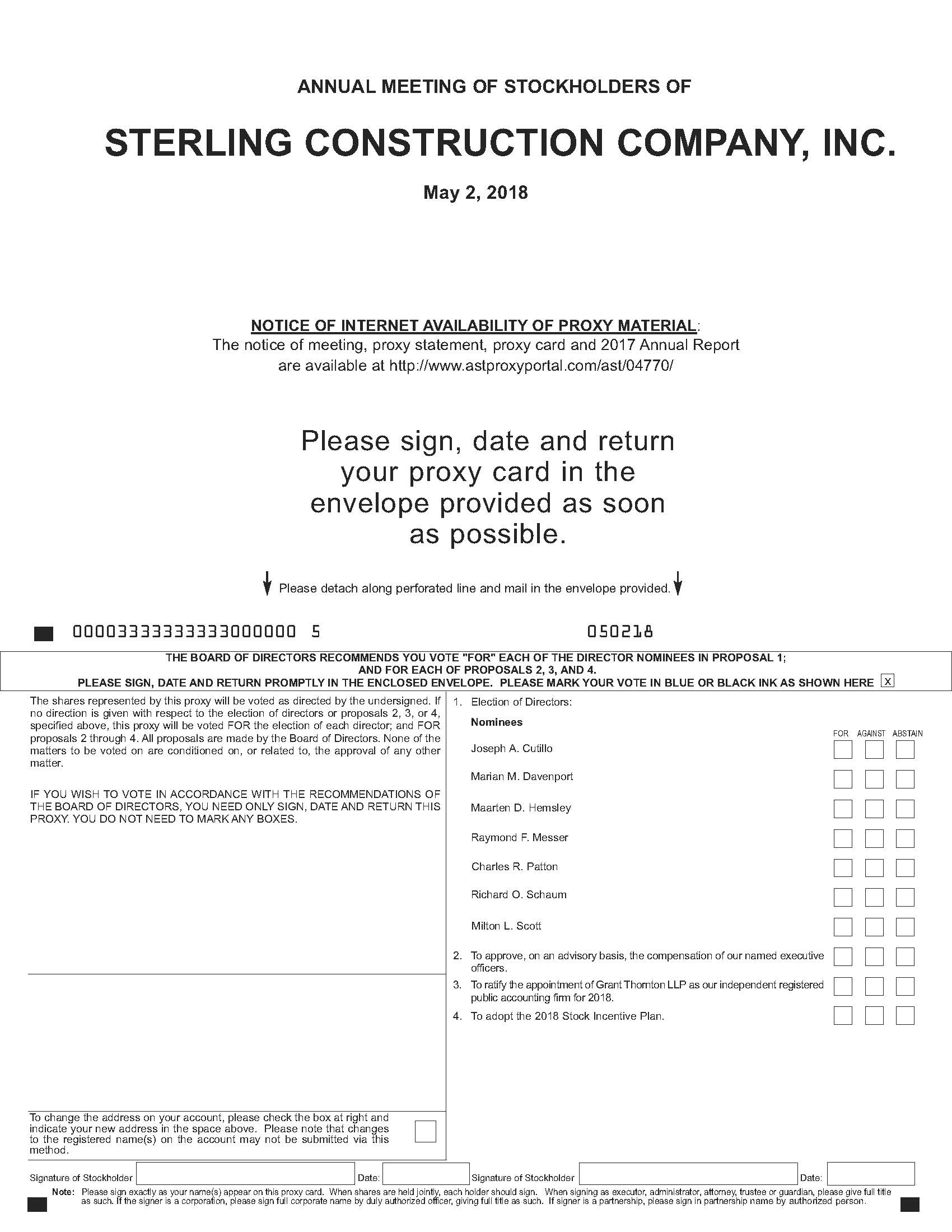

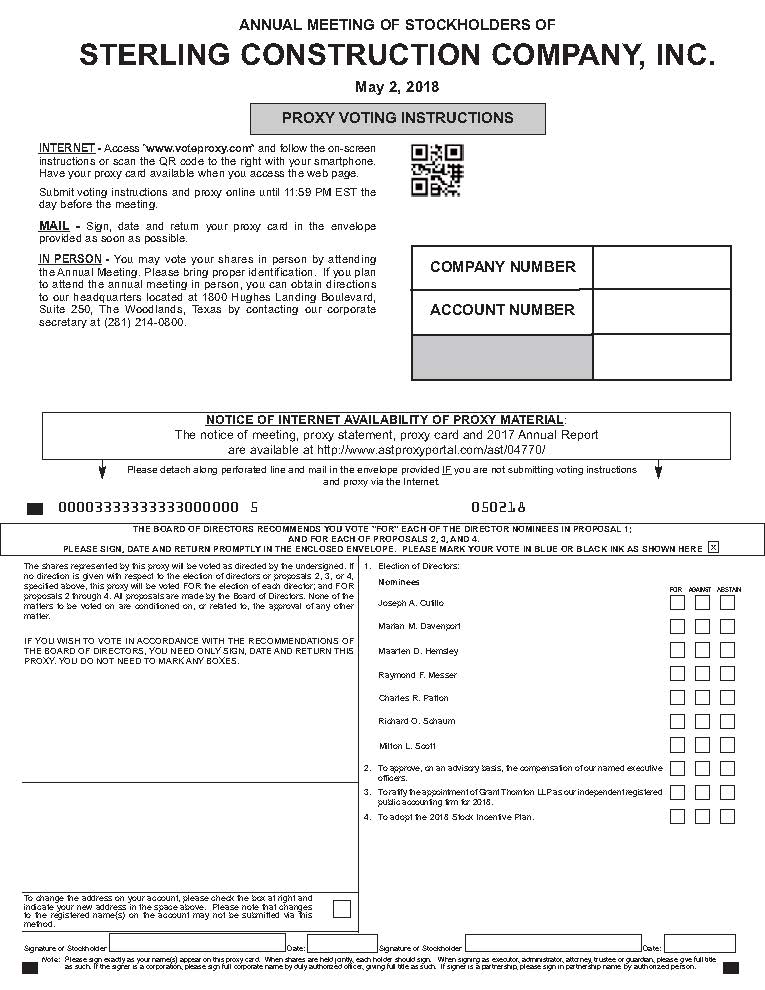

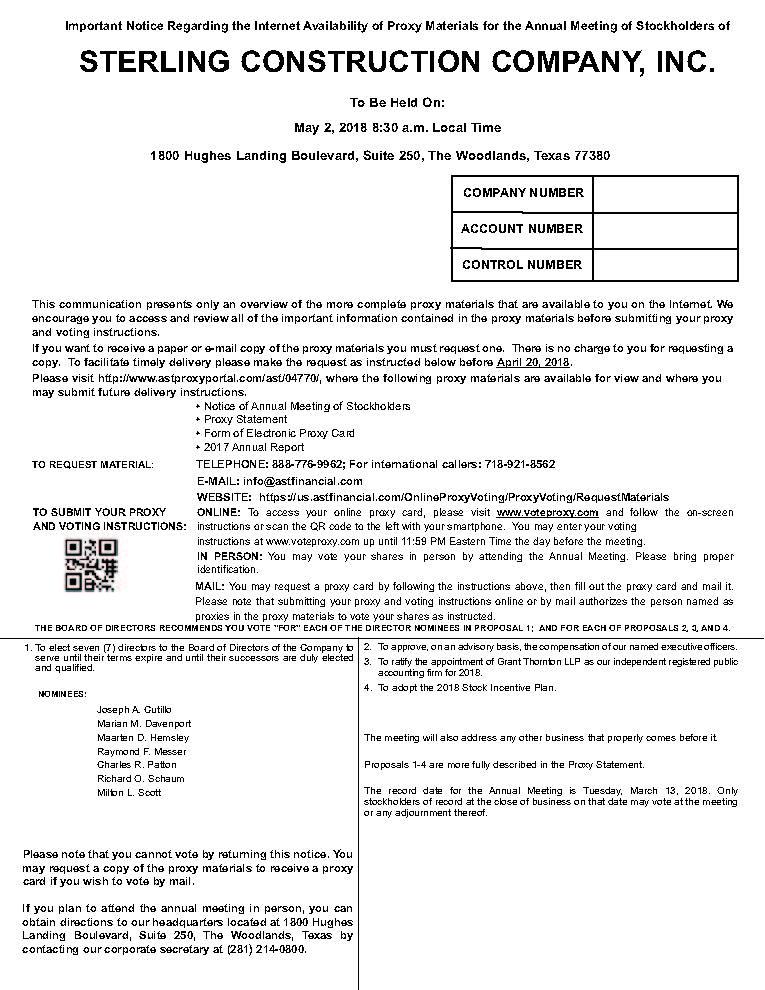

the 2016 Annual MeetingNotice is hereby given that the 2016 Annual Meeting of Stockholders of Sterling Construction Company, Inc.a Delaware corporation, will be held as follows:local timeDate:May 6, 2016Place:Place: — Time:8:30 a.m. local timePurposes:1.To elect five Board nominees, each to serve for a term of one year and until their successors are duly elected and qualified.2.To ratify the selection of Grant Thornton LLP as the Company's independent registered public accounting firm for 2016.3.An advisory vote to approve named executive officer compensation.4.To transact any other business that properly comes before the meeting.Record Date:Date: Only the stockholders of record atas of the close of business on March 8, 201613, 2018 are entitled to notice of the meeting and to attend or vote at the meeting, or at any adjournment of it.annual meeting.By Order of the Board of DirectorsMarch 24, 2016Proxy Voting:Roger M. Barzun,SecretaryImportant notice regardingavailabilityBoard of proxy materials for theDirectors.

2016 Annual Meeting of StockholdersMarch 20, 2018The

ANNUAL MEETING OF STOCKHOLDERSthe form of proxy and the Annual Reportcompany’s 2017 annual report to Stockholders for the year ended December 31, 2015stockholders are available at the Company's Internet website, www.STRLco.com, on the "Investor Relations" page under the headingsProxy Statements andAnnual Reports.As indicated above, we are again using the "Notice and Access" methoddelivery of proxy materials to save costs and to avoid wasting paper. Most stockholders will receive the Notice Regarding the Availability of Proxy Materials, which provides the Internet website address of our transfer agent where stockholders can both access electronic copies of the proxy materials and vote. This website also has instructions for voting by telephone and for requesting paper copies of the proxy materials and a proxy card.Contentssummary of how you can vote your shares Page Proxy Summary Via the Internet:You may vote via the Internet by following the instructions in the Availability Notice or on your proxy card (if you receive one).By Telephone:Visit www.voteproxy.com to obtain the toll-free number to call.By Mail:If you request a paper copy of the proxy materials, you may vote by completing, signing, and dating the proxy card, and mailing it to the Company in the envelope that is provided to you.In person:You may attend the2018 Annual Meeting of Stockholders and cast your vote on each item as it is presented. Agenda and Voting Recommendations STERLING CONSTRUCTION COMPANY, INC.Proxy Statement for the 2016 Annual Meeting of StockholdersTable of ContentsSUMMARY OF THE PROXY STATEMENTIMatters to be Voted on at the Meeting Director HighlightsISummary of 2017 Performance Highlights Executive Compensation Highlights II2015 Compensation Corporate Governance HighlightsIISummary of Corporate GovernanceIIIGENERAL INFORMATION Board Governance Guidelines; Ethics and Business Conduct Policy1The Record Date1Methods of Voting1Voting in Person1Voting by Proxy2Revocation of a Proxy2Quorum, Vote Required & Method of Counting3The Solicitation of Proxies & Expenses3The 2015 Annual Report3ELECTION OF DIRECTORS (Proposal 1)4Term of Office & Declassification of Directors4The Nominees & Continuing Director; Independence4Background & Skills of the Nominees & Continuing Director5RATIFICATION OF THE SELECTION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Proposal 2)9APPROVAL OF THE COMPANY’S NAMED EXECUTIVE OFFICER COMPENSATION FOR 2015 (an advisory vote) (Proposal 3)9THE BOARD OF DIRECTORS10Communicating with the Board10Board Governance10Independence10 Composition and Leadership Structure 10Declassification of Directors Board and Committee Meeting Attendance11Election of Directors by Majority Vote Board Committees11Directors' Attendance at Meetings in 201511Stock Ownership Guidelines & Policies11Claw-Back Policy12Board Evaluations12The Board's Risk Oversight12Selecting Director Nominees13Board Operations14Committees of the Board14The Audit Committee14The Audit Committee Report15The Compensation Committee15- i - Corporate Governance and Nominating Committee Special Committee Board and Committee Independence; Financial Experts Compensation Committee Procedures Compensation Committee Interlocks and Insider Participation 16The Compensation Committee Report Board Evaluation Process16The Corporate Governance & Nominating Committee Board’s Role in Oversight of Risk Management16 Director and Executive Officer Stock Ownership Guidelines Consideration of Director Nominees Communications with the Board Director Compensation 17STOCK OWNERSHIP INFORMATION Cash Compensation19Security Equity-Based Compensation 2017 Director Compensation Proposal No. 1: Election of Directors Information about Nominees Stock Ownership of Directors, Director Nominees and Executive Officers Stock Ownership of Certain Beneficial Owners and Management19Section 16(a) Beneficial Ownership Reporting Compliance EXECUTIVE COMPENSATIONExecutive Officer CompensationThe Executive Officers21Compensation Discussion and Analysis 22The objectives of the Company's compensation programs Compensation Committee Report22The elements of the named executive officers' compensation Executive Compensation Tables22How the amounts and compensation formulas were determined23The results of the most recent stockholder advisory vote24New incentive compensation arrangements for 201624Additional information on executive compensation25Compensation Policies & Practices — Risk Management26Employment Agreements of the Named Executive Officers27Potential Payments upon Termination or Change-in-Control29Compensation & Stock Tables.31 2017 Summary Compensation Table for 201531Grants of Plan-Based Awards in 2015201733Option Exercises and Stock Vested for 201535Outstanding Equity Awards at December 31, 2015201735Equity Compensation Plan Information 2017 Stock Vested36PERFORMANCE GRAPH Potential Payments upon Termination or Change in Control37TRANSACTIONS WITH RELATED PERSONS Pay Ratio38INFORMATION ABOUT AUDIT FEES & AUDIT SERVICESProposal No. 2: Advisory Vote on the Compensation of Our Named Executive Officers39Audit FeesCommittee Report39Audit-Related Fees39Tax Fees40All Other Fees (Non-Audit Fees)40Procedures for Approval of Services40SUBMISSION OF STOCKHOLDER PROPOSALS40- ii -SUMMARY OF THE PROXY STATEMENTA summary of some of the information contained in this Proxy Statement for the 2016 Annual Meeting of Stockholders is set forth on the following four pages. Each summary does not contain all the information that a stockholder should consider before voting. The entire Proxy Statement should be read before doing so. The Company's 2015 Annual Report is its Annual Report on Form 10-K for the year ended December 31, 2015, which has been filed with the Securities and Exchange Commission.Matters to be Voted on at the Meeting Appointment of Independent Registered Public Accounting Firm; Financial Statement

ReviewIndependent Registered Public Accounting Firm Fees and Related Disclosures for Accounting Services Proposal #1: The election of five Directors for one-year terms. The table below contains a summary of some of the information about the nominees for director. More detailed information can be found below under the heading Election of Directors (Proposal 1) at Page 4. Pre-Approval Policies and Procedures Nominees Current

PositionAge Occupation Board Committee Director

SinceMaarten D. Hemsley Director 66 Founder, Chairman and President

of New England Center for Arts

& Technology, Inc.1998 Charles R. Patton Director 56 President & Chief Operating

Officer of Appalachian Power CompanyCompensation 2013 Richard O. Schaum Director 69 General Manager, 3rd Horizon

Associates LLC2010 Milton L. Scott 59 Chairman and Chief Executive

Officer of the Tagos Group, LLC2005 Paul J. Varello Director 72 Chief Executive Officer of the Company N/A 2014 Proposal #2:No. 3: Ratification of the selectionAppointment of Grant Thornton LLP as the Company's independent registered public accounting firm for 2016. Grant Thornton was also the Company's firm of auditors for 2015. More information about Grant Thornton and their fees can be found below under the headingInformation About Audit Fees & Audit Services on Page 39.Our Independent Registered Public Accounting FirmProposal No. 4: Adoption of the 2018 Stock Incentive Plan Certain Transactions Proposal #3:Advisory approval of the compensation of the Company's named executive officers. More informationQuestions and Answers about the compensation of executives can be found in the following summaryProxy Materials, Annual Meeting and below under the headingExecutive Compensation on Page 21.Voting2019 Stockholder Proposals Proxy Statement Summary Page I Summary of Executive Compensation Annex A: 2018 Stock Incentive Plan This summary is qualified by the information below under the headingExecutive Compensation, which begins on Page 21. Named Executive Officers. The Company's named executive officers are those officers who are named in theSummary Compensation Table for 2015 under the headingExecutive Compensation. As noted below, two named executive officers left the Company in 2015. Except for Mr. Blair, the salaries of the named executive officers in 2015 were based on their employment agreements, or in the case of Mr. Ballschmiede, on an outline of employment terms. Mr. Blair has no employment agreement. After serving on an interim basis as Chief Financial Officer, as indicated below, he resumed his position as Senior Vice President, Corporate Finance.The Company's named executive officers for 2015 were as follows:A-1 NameTitle/PositionDate of ExecutiveOfficer StatusPaul J. VarelloChief Executive OfficerSince February 1, 2015Ronald A. BallschmiedeExecutive Vice President & Chief Financial Officer, Chief Accounting OfficerSince November 9, 2015Roger M. BarzunSenior Vice President & General Counsel, SecretarySince 2006Kevan M. BlairSenior Vice President & Chief Financial OfficerFrom July 3 toNovember 9, 2015Peter E. MacKennaFormer President & Chief Executive OfficerFrom September 2012through January 2015Thomas R. WrightFormer Executive Vice President & Chief Financial OfficerFrom September 2013to July 3, 20152015 Compensation. The table below shows the salaries, incentive compensation, bonuses and stock awards for 2015 of the named executive officers.

VarelloRonald A.

Ballschmiede

(1)(3)

Barzun

Blair

MacKenna

Wright2015 Annual Salary ($) $1.00 $400,000 $250,000 $250,000 $600,000 $375,000 2015 Cash Incentive Compensation/Bonus — — — $75,000 720,000 — 2015 Stock Awards (#) 600,000 100,000 — 3,971 — 136,259 2015 Stock Awards ($)(8) $1,932,000 $467,000 — $24,422 — $629,385(9) (1)Messrs. Varello, Ballschmiede and Barzun did not participate in any incentive compensation plan for 2015.(2)Mr. Varello's restricted stock award (vesting over three years) was in lieu of salary, and was approved by stockholders.(3)Mr. Ballschmiede served as a consultant to the Company's Audit Committee for several weeks prior to being hired as Chief Financial Officer, for which work he was paid $97,809. His restricted stock award (vesting over two years) was made to him in connection with his joining the Company.(4)Mr. Barzun is paid a $100,000 annual retainer for the performance of routine matters, which, after the end of the year is subject to increase by an amount that the Compensation Committee believes reflects appropriate compensation for the non-routine matters on which he worked during the year.(5)Mr. Blair participated in the Company's 2015 Long-Term Incentive Compensation Program under which he was awarded 3,971 shares of restricted stock that vest at the end of three years. Because he was unable to participate in the Company's 2015 Short-Term Incentive Compensation Program, he was awarded a $50,000 bonus for 2015. In addition, in connection with his assuming the role of Chief Financial Officer on an interim basis during 2015, he was awarded a $25,000 bonus.Proxy Statement Summary Page II (6)In connection with his leaving the Company's employ, Mr. MacKenna was paid his 2015 incentive compensation in full and in cash as if all 2015 goals had been met.(7)Mr. Wright participated in both the Company's 2015 Short-Term and Long-Term Incentive Compensation Programs. Under the Long-Term Incentive Compensation Program, he was awarded 29,871 shares of restricted stock vesting at the end of three years. In connection with his leaving the Company's employ, those shares were vested (as were the other shares of restricted stock he then held) and he was awarded 106,478 shares of unrestricted common stock.(8)These values are based on the closing price of the common stock on the date of the award, except as to Mr. Blair's 3,971 shares and 29,781 of Mr. Wright's shares that were awarded under the 2015 Long-Term Incentive Compensation Program pursuant to which the value was based on the average closing prices of the common stock in December 2014.At the 2015 Annual Meeting of Stockholders, the say-on-pay vote was as follows:Number of SharesEntitled to VoteVoted ForVoted AgainstAbstained13,173,92112,579,278 (95%)288,943 (2.2%)305,700 (2.3%)For more information about the named executive officers' restricted stock in 2015, see the tables below starting at Page 33.Summary of Corporate GovernanceThe Board has adopted a set of governance guidelines that it reviews periodically to ensure that they reflect the Board's and the Company's needs, as well as current trends in corporate governance.The following is a description of some of the main elements of the Company's corporate governance matters. A more detailed discussion can be found below under the headingThe Board of Directors in the section entitledBoard Governance beginning on Page 10:·Independence:o Of the Company's six directors, five are independent directors. The only non-independent director is the Company's Chief Executive Officer.o The roles of Chairman and Chief Executive Officer are separate, and the Board's Chairman is an independent director.o All members of the Board's standing committees are independent directors.o No director has entered into any related-party transaction with the Company.·At the 2015 Annual Meeting of Stockholders, the Board started the process of declassifying directors so that by the 2017 Annual Meeting, all nominees will be elected for one-year terms. See the section entitledTerm of Office & Declassification of Directorsunder the heading Election of Directorson Page 4.·Directors (in uncontested elections) are elected by a majority vote, with a director resignation procedure for incumbent directors who are nominated for re-election.·Meeting Attendance:o In 2015, all directors attended, in the aggregate, more than 90% of the meetings of the Board and of the committees on which they served.o All directors attended the 2015 Annual Meeting of Stockholders in person.Proxy Statement Summary Page III ·Executive sessions of independent directors are held at all four regularly-scheduled Board meetings and at other times as the need arises.·Two of the three members of the Audit Committee are financial experts.·Stock Ownership Guidelines & Policies:oDirectors and executive officers are prohibited from hedging shares of the Company's common stock.oExecutive officers are required to retain shares of the Company's common stock equal to a multiple of their base salaries.oDirectors are expected to hold shares of the Company's common stock with an acquisition value equal to five times their annual retainer.oThe Company's claw-back policy is applicable to incentive compensation paid irrespective of culpability, and applies to both cash and equity compensation.·The financial goals of incentive compensation programs are subject to caps and minimum achievement levels.·The Company currently has no change-in-control severance provisions in effect with any officer of the Company; however, their restricted stock vests in the event of a change in control.��Board Performance Evaluation:oBoth the Board and its committees perform a self-evaluation annually.oFor individual director evaluations, the Chair of the Corporate Governance & Nominating Committee confers with each director annually to solicit comments about nominations for election and re-election to the Board, and to permit each director to express any concerns about the functioning of the Board, its committees and its members. Any concerns about the Corporate Governance & Nominating Committee or its Chair are directed to the Chairman of the Board.·At each of the Board's regularly-scheduled meetings, directors receive an assessment and/or an update on the Company's primary risk categories.·The Company conducts annual advisory votes on executive compensation.·The Company has no stockholders rights plan (poison pill).Persons interested in communicating with the Board about their concerns, questions or other matters may do so as follows:By U.S. Mail to:Board of Directors℅ The SecretarySterling Construction Company, Inc.1800 Hughes Landing Blvd. — Suite 250The Woodlands, TX 77380orBy E-mail to:Reports@Lighthouse-Services.comProxy Statement Summary Page IV STERLING CONSTRUCTION COMPANY, INC.ii